Results Dutch IT Sourcing Study 2024 published

The 2024 Dutch IT Sourcing Study, conducted in collaboration with Eraneos, represents the largest survey to date. With more than 250 participants from the country’s leading IT-spending organizations, this year’s report provides insights on the top-performing IT service providers and cloud platform providers, with over 600 unique IT sourcing relationships and more than 800 cloud platform relationships evaluated.

The growth of the IT services market in the Netherlands is expected to continue in 2024.

The majority of clients (74%) intend to either increase or maintain their IT budget allocation for external providers over the next two years. 13% reveal they will reduce their IT budget spent on external providers, predominantly driven by financial reasons, while an additional 13% are uncertain about their sourcing plans.

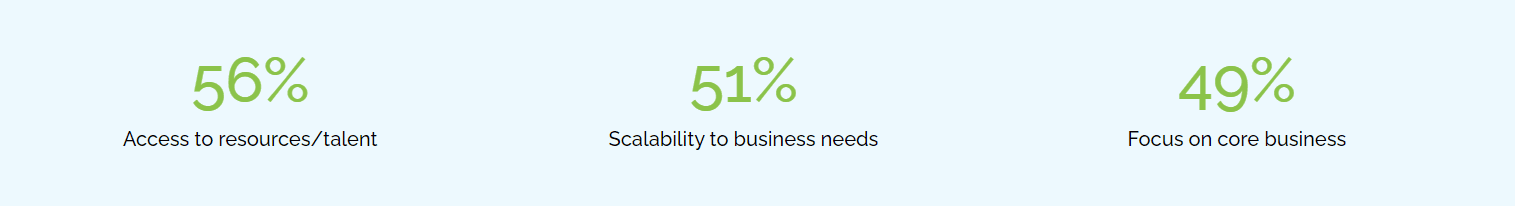

Scarcity of talent, scalability and focus on core business in a more uncertain economy are the main drivers for growth.

The primary driver for using external providers is access to resources and talent, cited by 56% of respondents, up from third place in 2023. Second in priority is scalability (51%), followed by a focus on core business (49%). Notably, cost reduction has seen a significant decline in importance, dropping by 16% to its lowest point to date with 23%.

Security and automation top the investment agenda of CIOs in the Netherlands; (Generative) AI investments see biggest increase.

Security remains the primary focus for investment, with 55% of clients intending to increase security measures and cyber defence capabilities over the next two years. Automation follows at 54%, while 51% plan to migrate core business applications to the cloud. Investment in AI/Machine Learning solutions has increased significantly by 21%, indicating growing recognition among clients of the competitive advantage that AI technologies offer.

In 41% of organisations, the adoption of AI/GenAI has already impacted the business; no transformation of business yet.

The survey indicates a diverse landscape in AI/GenAI adoption among organizations. 41% of organizations use AI with either a minor (36%) or significant (5%) impact on their business. 34% are still in the experimentation phase, and 18% have limited AI usage. None of the organizations have indicated that AI/GenAI has completely transformed their business.

Clients plan to increase nearshore to complement offshore/onshore; however, capacity may prove to be an issue.

Demand for nearshore delivery is up significantly: 44% of organisations expect nearshore to grow (versus only 6% of organisations who predict a decline). However, capacity in nearshore will not be able to cater for this significant increase in demand. Clients should be aware that pressure on rates and attrition are likely to increase; complicating large transitions to nearshore. The study reveals varied approaches to output-based contracting for application development services over the next two years: 36% intend to increase reliance, 28% foresee no changes, 6% plan to decrease usage, and 30% remain uncertain. The primary challenge cited by 69% of respondents is defining clear and measurable outputs within output-based contracts.

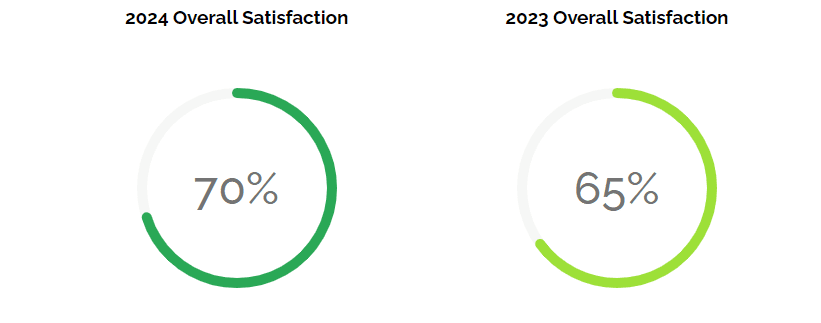

Out of the 604 IT sourcing relationships evaluated by clients, 70% reported being either satisfied or very satisfied. This marks an improvement of five percentage points compared to 2023, indicating a significant increase in client satisfaction.

Six service providers have achieved exceptional performer status across one or more IT service towers, with satisfaction scores exceeding the market average and above the standard deviation.

The exceptional performers are:

- Application services: TCS, EPAM, HCLTech

- Cloud & infrastructure services: TCS and Schuberg Philis

- Workplace services: TCS and Wipro

- Security services: TCS

- General satisfaction: TCS, Schuberg Philis, HCLTech, EPAM, Wipro and PwC.

Buy the full 2024 Dutch report, which rates IT service providers on six IT service towers and four key performance indicators, including ranking cloud providers on infrastructure and software cloud platforms.

Or request the Dutch management summary that reflects the key findings of the 2024 Dutch IT Sourcing Study. Contact our specialists Peter Luijendijk (Peter.luijendijk@eraneos.com) or Marcel Blommestijn (Marcel.blommestijn@eraneos.com) for more information.

Marcel Blommestijn

Associate Partner – Sourcing & IT Advisory

Sourcing Advisory

marcel.blommestijn@eraneos.com +31 20 305 3700 @marcelblommestijnPlease note that the management summary is only available to end-user organizations and not to service providers, consultants, etc.