Mergers & Acquisitions (M&A) describe the process of one company buying or selling assets, business units, or the entire firm to another company with the goal of enhancing, expanding, or streamlining business operations. M&A transactions often take shape in the form of a carve-out: the partial acquisition or divestiture of a business.

Several types of carve-out transactions exist depending on the circumstances and objectives of the deal. In an equity carve-out, for example, the parent company sells a portion of its ownership stake in a subsidiary through an initial public offering (IPO), allowing the subsidiary to become a separate publicly traded company. Another example are spin-offs where a subsidiary or division from the parent company is separated and integrated into the buyer’s organization or a dedicated holding company.

Planning and executing carve-outs is highly complex. Subsidiaries or divisions within the parent company are interconnected in terms of operations, IT systems, contracts, processes, and staff. Disentangling these systems to establish standalone operations requires detailed planning, knowledge across business / IT domains, and an experienced project team that can deliver on time and under pressure.

To ensure successful operations of the carved-out entity, Transition Service Agreements (TSAs) between buyer and seller are agreed upon and signed. TSAs define services, resources, and support of the parent company towards the carved-out entity during a transition period after deal closure. Negotiating, planning, and executing comprehensive TSAs requires a clear definition of responsibilities, costs, and timelines.

At Eraneos, we have successfully delivered multiple highly demanding carve-out projects. One of our most recent projects is unrivaled in terms of actuality and excitement. Eraneos supported a client in orchestrating an M&A carve-out transaction in a region with geopolitical tensions and conflicts. Prior to and during the transaction, the regulatory environment surrounding the conflict area was constantly changing, increasing the complexity of the carve-out. Together with our client, Eraneos was navigating unchartered waters.

From a strategic point of view, the first key decision point was deciding whether to continue or discontinue operations within the conflict region where the client had established production and sales units in the past. Not knowing how long the conflict would last and how the regulatory environment would develop, our client had three strategic options to choose from –

1. Immediately stop business operations

Implementing a hard cut entails terminating contracts, suspending all production and sales activities, and completely shutting down operations. For our client, a hard cut would have caused financial losses in a market it previously had invested significant capital and resources in to build production plants and sales organizations. In addition, a hard cut would have caused a loss of know-how and skilled labor in areas such as IT, R&D, and production.

2. Continue business operations while navigating the changing regulatory environment

Staying in the conflict region would have created the need for our client to increase focus on risk management, closely monitoring and complying with an intensifying regulatory landscape, navigating strong currency volatility, as well as rethinking their supplier network and customer relationships. Moreover, our client would have risked reputational damage through damaged brand perception and non-compliance with increasing sustainability / ESG standards.

3. Sell existing operating units / entities within the conflict region through a carve-out transactions

Selling business operations would keep financial losses at a minimum whilst exiting the region. For our client, however, putting together Transactional Services Agreements (TSAs) and managing compliance / litigation risks while navigating the country’s regulatory environment and international sanctions at the same time, seemed like a daunting task. Another concern to our client was the interconnected sales, HR, procurement, production, and IT systems which needed to be separated and could cause severe business disruption events.

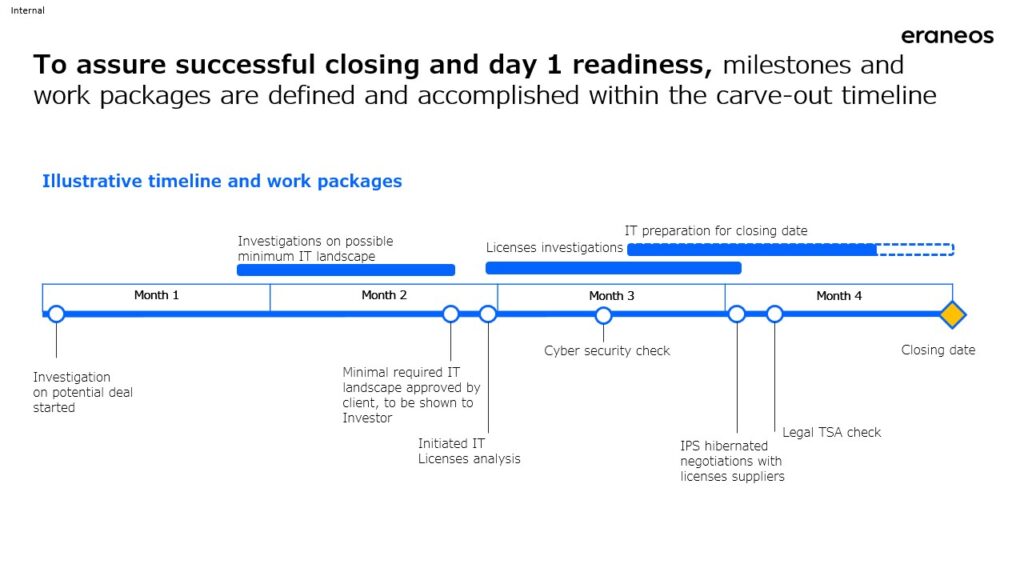

After much deliberation and weighing the pros and cons under time pressure, our client decided to sell its business operations and carve-out its business in the region. Once the decision was made, Eraneos advised the client’s management team on the carve-out transaction, starting with defining the minimum possible IT setup required for a financial investor to take over and operate the carve-out business.

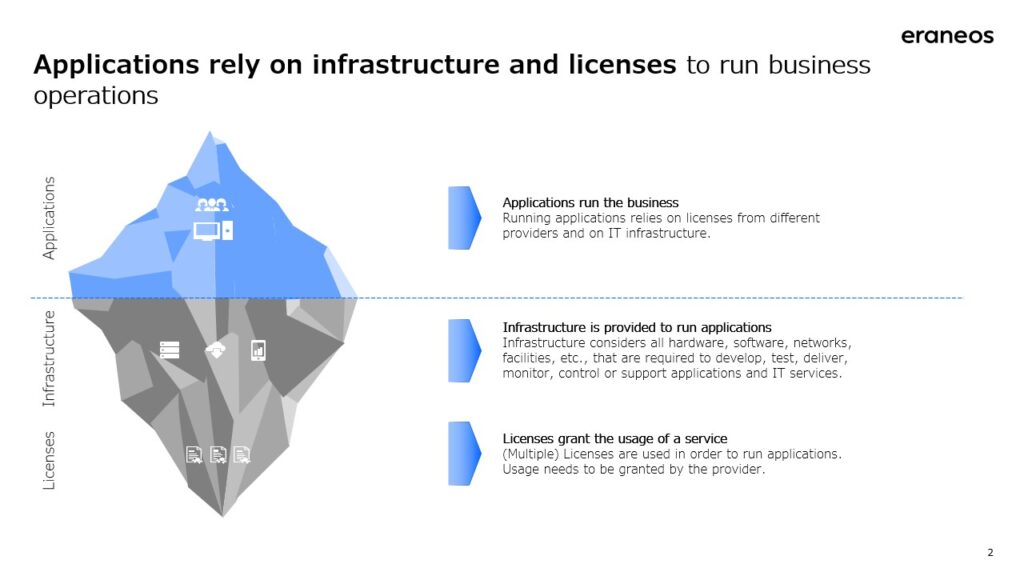

Once the minimum required IT landscape was defined, Eraneos investigated licenses, infrastructure, and applications to detail and define the target IT setup enabling the investor to operate the separated entity. This, for example, included identifying business-critical applications for procurement, finance and controlling, manufacturing, and sales where continued service provision from the seller (our client) to the buyer was required.

During the carve-out process, the regulatory environment surrounding the conflict region constantly evolved, which created regular changes to the carve-out scope and timelines. Eraneos supported the client in evaluating the impact of evolving regulations from a legal, IT, and operations point of view.

One challenge, for example, was increasing disruptions to business functions and communications within the region causing complications in defining post-deal handover scenarios due to limited IT support capabilities. Another challenge was client software, which also had potential defense and military functionalities (so-called “dual-use” software). Managing “dual-use” software within the carve-out scope was especially challenging due to the intense regulations surrounding these applications.

Based on our project experience, we believe companies need to have a clear understanding of the regulatory environment they are in and should seek expert advice to ensure compliance. The strategic decision on continuing, exiting, or selling operations and the execution of the decision requires a thorough analysis of risks, opportunities, costs, and overall fit with the client’s strategy.

Despite the challenging circumstances, Eraneos successfully engaged with the client and achieved successful transaction closing of the carve-out. With all stakeholders aligned and comprehensive TSAs implemented, the client was able to exit the region while safeguarding investors’ operations and protecting against the downsides.