When it comes to increasing relevance in the market, pension funds and providers are teetering on the edge of a major transformation. In recent years, they’ve come to realise that relevance will play the most important role in their future given WTP. How, exactly, is largely still up for debate, however.

A whole new perspective on pensions, for everyone

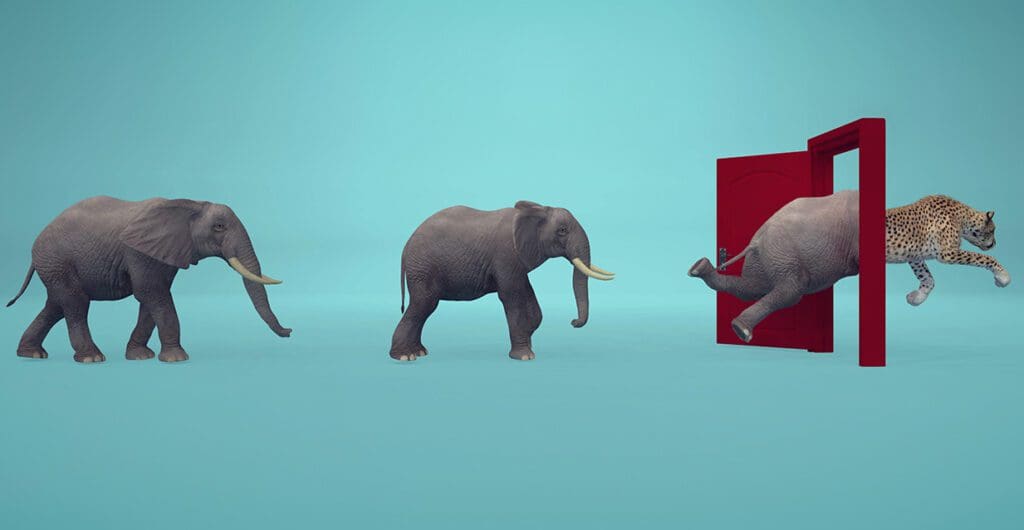

One thing that might shine a light on this enigmatic future – and something we’re seeing pop up again and again in industry conversation is ecosystem thinking. That is, the idea of shifting away from the value-chain view where companies think they can develop their products and create value for their stakeholders on their own within a closed system. It’s a broader concept, embracing many interconnected partners who wish to create shared value, together.

As an advisory firm with innovative solutions to emerging questions, we work on challenges like this across several industries. In this article, we’ll break down how industries like pension funds and providers might find their way to investing in relevancy, hedging the service portfolio, and creating meaningful and sustainable collaborations with new players. Here are the most common changes pension funds and providers are currently facing.

Pensions: Drivers for change

The world of pensions isn’t necessarily the first industry you’d associate with innovation. However, that’s all beginning to change, and quite rapidly. In fact, it’s predicted that the sector will embrace more change in the next five years than it has seen throughout the past 25.

The two main external drivers for change are as follows:

- New entrants present themselves as PensionTech; digital-savvy start-ups and scale-ups introducing new business models and new concepts within and across industries. PensionTech firms offer established pension providers an attractive opportunity to expand their portfolio.

- Digital-savvy generations, such as Gen Z and Millennials, are entering the pension market. It goes without saying that these generations have different expectations, and expect more personalised, interactive, and omnichannel, digital experiences as they look to take ownership of their financial future

New pension system in NL

In addition to the drivers for change mentioned above, there will be another force dominating the change agenda in the Netherlands and that’s the Dutch pension system, which will soon transition (2023-2027) to a contribution-based pension system. Pension providers will no longer make promises about the amount of benefits they intend to pay out in the future. This approach requires pension providers to offer pension members a number of benefits, including insights, personalization options and potential scenarios.

A member-centric mindset

The pension industry is set to reinvent itself over the next few years bringing along many challenges and opportunities. This is especially evident within member activation, interaction, communication and personalisation, where a lot of white space needs to be addressed. In order for this to come to fruition, pension providers and administrators will need to extend their data capabilities, grow their innovation portfolio and, most importantly, embed a member-centric mindset in culture and strategy and from an ecosystem point of view. This will provide the market with differentiating propositions.

The perfect storm

The pension landscape with its market consolidation, IT and migration challenges, cost reduction targets, and increased focus on sustainable investment strategies already has to deal with many developments. Together, with the importance to develop and introduce new, member-centric value propositions, the combination might well create a ‘perfect storm’ in the pension industry. As a result, many pension providers and administrators are currently reviewing their strategy, partnerships and overall future direction.

Ecosystems: a starting point

Because of the interdependencies between pensions providers, social partners, PensionTechs, employers, members, pension administrators, asset managers, communication platforms and so on, the pension ecosystem is the obvious starting point when rethinking the corporate strategy. Ecosystems create a coherent value proposition that is greater than the sum of its participants’ individual value propositions. It’s especially possible that collaborations with PensionTechs have a big impact on the market, and therefore create synergies with established pensions funds and administrators. This could prove lucrative for all parties involved, as long as the PensionTechs maintain their speed and customer-centric approach, and the established pensions funds and administrators contribute their know-how, data and financial resources.

Courage required

To deliver a shared value proposition within their ecosystem, participants must cooperate all the way down to the strategy level. This is why it’s important to determine as early as possible whether the ecosystem approach is compatible with your organization’s long-term vision and its own goals. Ecosystems are long-term decisions. It takes courage and foresight to fully embed the ecosystem model into your strategy.

If there’s one major take-away from these highlighted changes, it’s that each pension organization should refresh its strategy to an ecosystem point of view to provide the market with differentiating, member-centric value propositions.

Why Eraneos?

We have extensive knowledge of all relevant aspects in the pension industry and combines this with our innovation expertise. This results in insightful client half-day workshops around key questions like:

- Map and scope your ecosystem: Zoom out and take a bird’s eye view. Look at the relevant customer journeys, the value proposition, the competition, related markets, the pensiontechs impacting the niches, the possible involvement of big tech, your current partners, suppliers and employees.

- Imagine your role in the ecosystem: What are your crown jewels in regards to customer-facing activities? Can they exist on their own or are they glued to your non-customer-focused activities? What are your differentiating non-customer-focused activities? Can you offer these activities ‘as-a-service’ to others?

- Define the best long-term strategy for your organization: What is your business model today and how will it evolve over the next five years? What is the ecosystem’s business model today and how will that, too, evolve in the next five years?

Contact us to explore together the best approach for possibly the most important strategic decision in this decade for every organization active in the pension industry.