Banks rely on AI – but employees are reluctant. While managers promise efficiency and a bright future, many employees are skeptical and reject the idea. Gamification is supposed to offer a way out. Is the concept of gamification a clever solution or just a gimmick in an industry that demands seriousness?

AI – besides DORA – one of the most relevant topics for CIOs and CTOs in Financial Services, nowadays. There are few areas in which massive investments are not being made in AI-supported technologies. Expectations are high – automated processes, smarter decisions and improved customer experiences should pave the way to a future with widespread use of AI-based tools.

One central problem often remains unmentioned – employees are not following suit, especially in the business areas that are not too IT-related. While technically innovative IT and management see AI as the key to making work processes more efficient, many employees are indifferent or even highly skeptical and reject the new technologies.

Why employees often avoid AI-supported tools

Ideation workshops and potential analyses promise a multitude of use cases for the use of AI. Those who do not participate will be left behind by the competition. There is great enthusiasm among managers, as the use of AI promises gains in efficiency, enables the processing of large amounts of information and gives rise to hopes of quality gains in decision-making processes – this applies to small-scale, operational as well as strategically important and complex ones.

Although AI has the potential to revolutionize work, AI-powered tools are often rejected by those who are expected to use them on a daily basis.

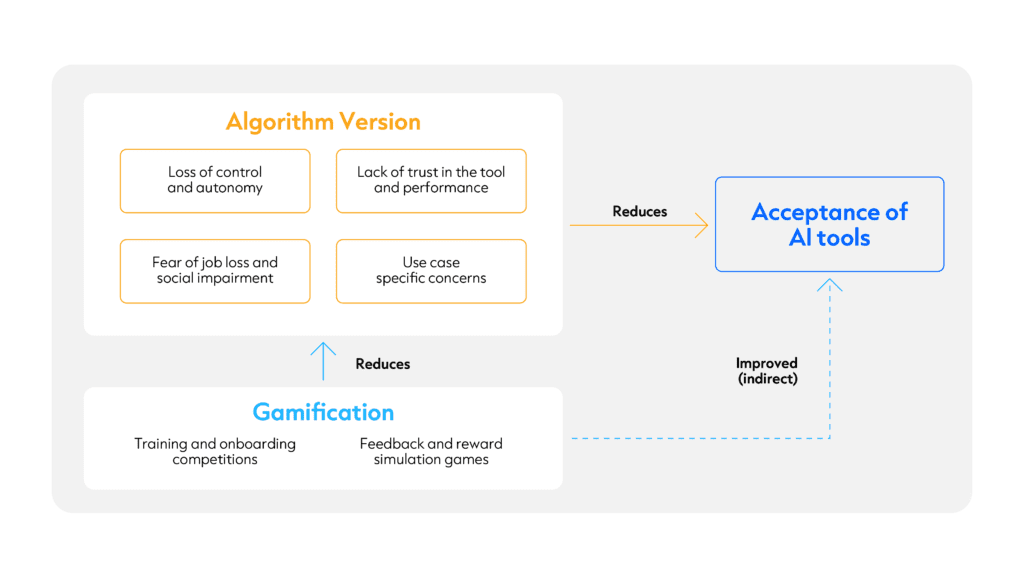

This phenomenon is known as “algorithm aversion” and is one of the so-called “cognitive biases”, i.e. human errors of judgment. Algorithm aversion can be observed above all in tools that provide support in areas where complex decisions are made, for example in overall bank management or controlling. There are various reasons for this, which can be summarized in four categories:

- Loss of control and autonomy – AI-supported tools are often perceived as “black boxes”. People who do not understand how a tool works and how recommendations are made are reluctant to use it.

- Lack of confidence in the reliability of the tool and its performance – Individual misjudgements, especially at the beginning of use, can lead to a complete loss of trust in the tool. In addition, the relevance of ethically correct recommendations is increasing more and more; this is accompanied by a fundamental, initial doubt.

- Fear of job loss and other social impairments due to use – Banks are highly regulated and traditionally structured organizations. Changes are often met with resistance here – especially if they are perceived as a threat to the existing way of working. A lack of accompanying change management and a fundamentally “AI-positive” corporate culture give rise to such fears. Even if job profiles could change in the future, there is currently every indication that the “human-in-the-loop” who makes the final decision will remain necessary in the future.

- Use-case-specific concerns: This includes an initial fundamental doubt about the suitability of the specific tool for the individual use case. How can banks reduce their employees’ fears of AI and motivate them to use new tools?

Gamification: More than just a game

One approach that may seem unorthodox at first is the use of “gamification”. Gamification, i.e. the application of typical game elements in a non-game (professional or educational) context, has found its way into many industries in recent years, particularly in the educational sector. Different others are adopting it, however, it´s spread in the context of business and management is low.

The approach of gamification also works in banking, traditionally one of the most serious and rule-oriented industries. Gamification offers several ways to make the use of AI-supported tools easier and more attractive:

- Training and onboarding – Gamification can help by making the learning process more exciting and interactive. Employees could be rewarded with levels, badges or rankings when they successfully complete certain learning modules or tasks.

- Competition as a motivator – Internal competitions in which employees collect points for using AI tools could arouse ambition and curiosity. Who can solve a certain number of tasks more efficiently using AI? Who collects the most points and becomes an “AI expert”?”

- Simulation games – Complex AI tools could be learned through simulations in a safe environment before they are used in real day-to-day work. Employees could playfully experience how AI simplifies their work without fear of making mistakes.

- Feedback and rewards – Gamification also offers the opportunity to continuously analyze user behavior and improve it based on feedback. Employees receive direct feedback on their performance and can be further motivated by reward systems.

Figure 1 summarizes how gamification can be operationalized and impact the negative influencing factors of AI acceptance.

Psychological background: Why gamification works

Gamification is based on psychological principles. People learn through positive reinforcement and enjoy the feeling of mastering challenges and achieving success. In doing so, they compare themselves with other, usually similar people in a certain environment and try to get as close as possible to them and their behavior (the social comparison theory provides exciting explanations and further impressions here). By integrating playful elements into everyday working life, the intrinsic motivation of employees is increased.

This means he use of AI tools is no longer perceived as a chore, but as a challenge that needs to be mastered – especially in order not to lag behind colleagues.

A positive side effect is that the opportunity to learn and develop at your own pace and thus retain control over your own learning progress triggers a feeling of self-determination and control – a decisive factor for the acceptance of new technologies, see Figure 1.

Challenges and limits

Gamification elements must be used sensibly and purposefully and must not jeopardize the perceived integrity of the bank. Regulatory requirements must be complied with, which regularly makes the introduction of further gamification applications more complex. In a world where competition, comparison and measurement are omnipresent, creating further competition between employees is not always the best choice.

Solution selection and integration of gamification tools into the IT landscape

The first step is to make a make-or-buy decision. In-house developments can be implemented on the basis of frameworks such as the Microsoft Power Platform or Salesforce, for example. Existing platforms are available as SaaS, for example Badgeville or Bunchball. This is followed by implementation, where the following success factors, among others, must be taken into account:

- Single sign-on – Ideally, gamification solutions are integrated into the bank’s existing access management system. This allows easy use by employees (high relevance in terms of acceptance) and facilitates user tracking.

- Data connection and APIs – Easy integration into central databases and systems is necessary in order to obtain data for challenges and tasks. An API interface is essential to enable data exchange between existing systems, the gamification platform and, above all, the AI solution, which is ultimately about increasing usage.

- Security and compliance – As this generally involves sensitive data (employee data), strict security standards and compliance/regulatory requirements (such as those from the GDPR and DORA) must be observed.” Encrypted connections, Role-Based Access Control (RBAC) and monitoring must be integrated.

Conclusion: Gamification as an “AI enabler”

The introduction of AI in banks will not succeed by force or order – but through motivation and enthusiasm. Gamification offers a promising approach to actively involve employees and increase the acceptance of AI tools.”

By integrating playful elements into everyday working life, a culture of openness and curiosity, as well as rewards for experimentation and courage, can be promoted, which will drive the acceptance of AI in the long term. For IT managers, this means: Give it a try – gamification is more than just a gimmick. It is a strategic tool that – if set up correctly from the outset – can help to successfully shape the transformation to a data-driven and AI-using organization.

In addition to practical experimentation, the scientific literature has also been exploring the possibilities of gamification for increasing the acceptance of technologies for several years.

This article was originally published in it-finanzmagazin.de.